BDC Update: Sixth Street Specialty Lending

April 5, 2024

It's Time

We've been writing a lot about Sixth Street Specialty Lending (TSLX) in 2024, both in the BDC Reporter and the BDC Credit Reporter. The mid-sized BDC has been busy issuing new shares, raising unsecured debt, reporting above-average IVQ 2023 results (rated 4 on a 5 point scale) and is deeply involved in two leading retailer bankruptcies (Bed Bath & Beyond and now 99 Cents Only Stores). What we've failed to do is write about TSLX on these pages and explain our much-changed long-term projections. So here goes!

Time Flies

We last wrote about TSLX in early 2023, referencing the 2022 results. A year has passed in which the BDC posted a record high return on capital. Here's how management described their performance:

For the full year 2023, we generated adjusted net investment income per share of $2.36, representing a return on equity of 14.4% and a full year adjusted net income per share of $2.66 or return on equity of 16.2%....Over the last 2 years, we experienced the fastest rate hike in [recent?] history, contributing to increased volatility and economic uncertainty. Despite these headwinds, we generated an average annualized return on equity on adjusted net income of approximately 12% for fiscal years 2022 and 2023. While we don't have a complete set of pure data available yet, we believe these returns are nearly double that of our peers over the same 2-year period. That is supported by a 2-year return on equity on a net income of 6.5% for our peers, due September 30, 2023.

Robust

Adjusted net investment income per share - a non-GAAP metric management favors - increased 17% in 2023 over 2022 - to $2.36 from $2.01.

Topped Out?

However, going by management's commentary on their most recent conference call, that might be as good as it gets now that lower interest rates are on the 2024 horizon.

As we've said on our last 2 earnings calls, we believe BDCs were at peak earnings, and we reiterate this view based on the shape of the forward interest rate curve. More broadly, our outlook for the sector remains cautious, as we know from history that credit deterioration takes time, and therefore, losses lag. This was evidenced during the global financial crisis, which began even in 2007 and defaults in the peak until 2009. As the credit cycle continues to evolve in 2024, we expect to see 3 impacts for this sector. First is a decline in net investment income, driven by the downward shape of the forward interest rate curve. Second is an uptick in non-accruals from credit deterioration resulting in further declines in net investment income. And third is a downward pressure on net asset value, driven by the potential for lower fair values from credit weakness and dividend policies in excess of earnings that result in a return of capital

Maybe. Maybe Not.

TSLX is unusual in the BDC space in providing earnings guidance. The BDC projects 2024's adjusted net investment income per share will range between "$2.27 to $2.41 for full year 2024 ". Technically, that means earnings could yet beat the 2023 mark, but could play out to be several percentage points lower.The analysts are projecting the number will be $2.34 - a tiny drop from 2023.

Paid Out

The BDC is sitting on $1.04 per share of undistributed earnings and has made clear its intention not to hoard too much of future earnings to avoid paying the dreaded "excise tax" the government levies in such situations. That seems to augur a continuation of generous distributions - both "regular" and "special". In 2023, TSLX paid out $2.10 per share - 14% more than in 2022. We're projecting a payout of $2.00 per share in 2024, 4 regulars of $0.46 or $1.84 and two specials of $0.08 or $0.16. If we really get little - or no interest rate cuts - in the back half of 2024, the total payout could easily be higher - as much as $2.16 per share.

Down The Road

In future years - as rates fall by 3.0% - bringing the SOFR rate ultimately down to 2.3% from 5.3% currently - both earnings and distributions will fall more sharply. TSLX is pretty much fully invested so no incremental earnings are expected from a larger portfolio, but management guides us to expect higher transaction fees from an expected greater volume of new deals. However, that can only slow down the inexorable drop in earnings that lower interest rates will cause. Adjusted NIIPS in our projection drop to $2.12 per share from $2.36 in 2023. (The most recent earnings are annualizing at $2.48, so the projection assumes a 15% drops in profitability).

Drooping

Total distributions - notwithstanding the undistributed earnings - will come down as well, falling to $1.80 per share per year in 2027 and 2028, according to our projections. That's not very different than the $1.81 paid out by TSLX in 2019 - when our records begin for this metric. Like with earnings, distributions will ultimately end up about (15%-17%) lower than the current levels.

Other Assumptions

As before, we continue to expect TSLX to maintain a "stable NAV" over the next 5 years as occasional equity gains; selling shares at a premium to book and retaining earnings offset any impact on capital lost to bad debts. Since 2018, TSLX has managed to increase its net book value per shares by 5%, so this assumption about the future seems reasonable. The current credit performance of the BDC - which only has 1 portfolio company non-performing - is encouraging, and supports our optimism about a "stable NAV" going forward. If we're right both about the earnings in 2028 and the net book value, the BDC's return on equity should be a 12.4%. That's well below 2023's record level we mentioned earlier but would still be something to brag about.

Valuation

Recommendation

February 17, 2023

One Year Anniversary

We've not written an Update about Sixth Street Specialty Lending (TSLX) since this time last year, and before interest rates went haywire. At that point, BDC Best Ideas was just getting going and so was the Fed. Nonetheless, we're pretty happy with the projections we made for earnings and distributions in 2022. The EPS - which we just borrowed from management's prediction - was going to be $1.9200, but ended up at $2.0100. The total payout instead of being $1.9200 as we projected ended up at $1.8400. Finally, we projected the distribution level from 2023-2026 would be $2.00 annually.

Re-Think

Now that we've reviewed TSLX's IVQ 2022 results, glanced at the 10-K, and read the conference call transcript, we need to re-set payout expectations for 2023-2027. The principal reason why is that interest rates have risen hugely since our last assessment, materially lifting the BDC's outlook. Otherwise, TSLX is operating at a very similar debt-to-equity level as before, with a similar philosophy, and credit results are not much different. The now much clearer interest rates picture, though, is drastically changing TSLX's earnings power.

Numbers Tell The Story

Just in the IVQ 2022, investment income at the BDC increased from $78mn to $100mn. That's a remarkable 28% jump in just 3 months. Adjusted Net Investment Income Per Share - a favorite non-GAAP metric - was annualizing at $2.56 in the final quarter of 2022 - which also represents a 28% increase over the actual result for all of the year. Plus, interest rates are still rising in 2023 and portfolio loan yields edging higher. Management on its conference call offered EPS guidance for 2023 of $2.13 to $2.17 and also admitted undistributed net investment income per share was $0.77.

Careful

As is often the case with TSLX, its management's dividend policy is very conservative - almost to the point of being unrealistic. Despite a huge jump in earnings and outlook, the BDC only increased its regular quarterly distribution by $0.01 per share to $0.4600 for IQ 2023. (Admittedly there have been 3 increases of late, adding up to 12%). Clearly, recurring income is much higher than recurring distributions.

So Special

Management is leaning on variable amounts of "special" distributions to make up the difference between what is due to be paid and its regular distribution: $0.09 per share most recently. Unlike some other BDCs TSLX does not mind paying out its earnings in a lumpy manner, which can be difficult for shareholders to estimate and must weigh on the stock price. Anyway, that leaves us to make educated guesses, and we're projecting 2023-2024 will see a total payout of $2.5000 for each year, consisting of current earnings and that "spillover income" left over from prior periods.

Gentle Decline

From 2025 on, as interest rates come down, we expect earnings and total distributions to take a step down to $2.2200 a year through 2027. Offsetting some income lost to lower rates will be higher fees from a greater level of repayment activity - a subject much discussed on the latest conference call. We don't expect much in the way of benefit from higher leverage or much higher borrowing cost, but wider spreads on new loans booked in 2022 and 2023 will continue to boost earnings for several more years.

New Valuation

Less Popular

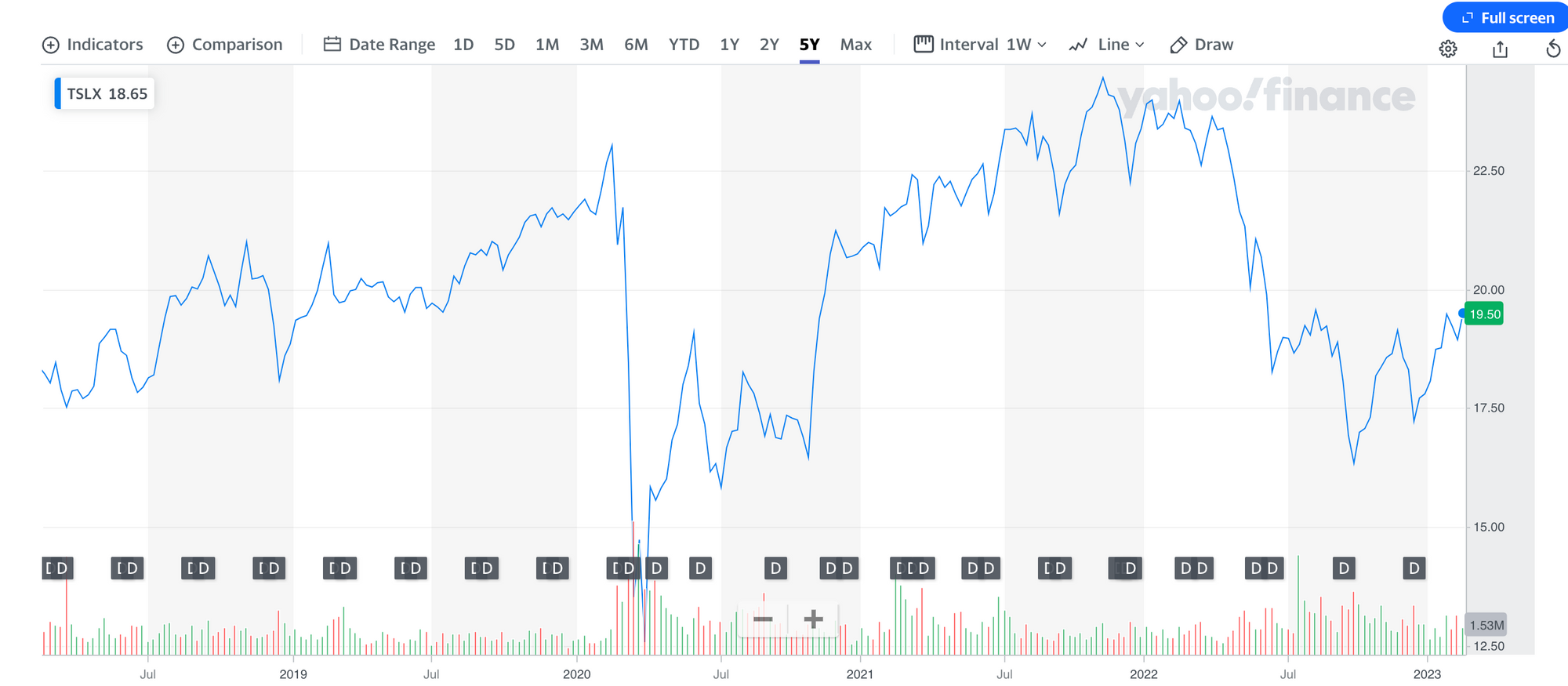

The substantial upside in TSLX's return reflects in part the projected higher earnings. However, it's also true, as this 5-year stock chart below shows, that TSLX has been trading down of late - (20%) below its 52-week high and underneath the pre-pandemic heights. Over a 1 and 2-year period, TSLX has trailed the sector on a price change basis.

Current Valuation Metrics

Going by the analyst EPS consensus for 2023 of just $2.18 (which seems very low), the BDC is trading at a relatively modest 9.4x Price To Expected Earnings. Yes, the price to net book value is at an 18% premium, but that metric has typically been much higher. TSLX is not "cheap", but not expensive either, and worth a look. This is a serious-minded BDC with a big-name parent and a differentiated business strategy that has performed very well over the years and "deserves" a higher multiple.

February 21, 2022

Undeniable

Sixth Street Specialty Lending (TSLX) reported IVQ and full year results, which we reviewed at great length in the BDC Reporter, both in the Daily Update and in a full article annotating the latest conference call transcript. In a nutshell, the large-cap, "idiosyncratic" BDC had a very good 2021 by every key metric: EPS, credit, adjusted NAV Per Share, and - most of all - distributions. The $3.59 per share in payouts of regular, supplemental, and special dividends were way in excess of earnings achieved, even when realized gains are taken into account.

Low Ball?

That was good for 2021 TSLX shareholders but makes almost certain that distributions going forward will be lower, even as we expect EPS to continue to be strong for the next 5 years. Management has projected 2022 adjusted Net Investment Income Per Share might reach as high as $1.92. This was challenged by one analyst as deliberately undershooting, which may be the case. On the other hand, the BDC does have to contend with a slew of new shares later in the year when $100mn of convertible debt becomes more equity. Moreover, new investment activity was high in 2021 and that might not be matched in 2022, even though management argues that this should be offset with better results from maintaining the existing portfolio.

Reviewed But Not Revised

Where TSLX is concerned the path of earnings and dividends tend to widely diverge and we're not particularly concerned about guessing just right for one year. We continue to project (as we've done for months) that the distribution in 2022 will amount to $1.92, then increase by $0.02 to reach $2.00 in 2026. That's a total of $9.80 of distributions through 2026. TSLX has announced a IQ 2022 regular dividend of $0.41 and a supplemental of $0.11, so we're on track. Lower new deal activity in the typically slower first half of the year may shave down the next couple of supplementals, as will any increase in short-term rates until the 1% plus loan floor level is reached as borrowing costs - all of which are tied to LIBOR/SOFR increase while income does not.

Not Getting Ahead

Speaking of the above, we've not yet adjusted projections for future dividends for potential higher rates. This is true across the board for the BDCs we track. TSLX was not shy to say that they expect - a little unbelievably - that the "reference rate" will be over 1.1% by the second quarter of 2022, just months away. Moreover, the BDC has not been shy to preview on its conference call the potential increase in earnings that would come with higher reference rates:

To give an illustrative example of the impact once we reach our floors, assuming our balance sheet remains constant as of Q4 2021, for every 100 basis point increase in rates, we would expect approximately $0.14 per share of uplift to annual net interest income.

Unchanging

For the moment, though, we're leaving those possibilities alone in our projections and valuations. We continue to feel that with TSLX well within its 1.25x debt to equity target leverage (under 1.0x at year end 2021); loan yields constant; borrowing costs low and no income erosion from bad credits our 5 year dividend projection is reasonable. For example, our payout projected for 2026 is just below what the analysts are predicting for adjusted Net Investment Income Per Share in 2023.

Decent

The current yield - assuming the $1.92 in dividends paid out in 2022 - is 8.0% and the Target Price of $27.00 is only 9% above the BDC's 52 week and all-time high price. Currently the 5 year return is 54%, or 10.7% per annum. Given that we're being relatively restrained about the outlook for future dividends and the BDC is trading at a huge premium to book and to earnings that's a fair, but not exciting return. By comparison, Seeking Alpha shows the BDC's total return over the last 5 years was 108%. We are big fans of TSLX but - unfortunately - so are many others.