BDC Market Snapshot: Week Ended April 6, 2023

Going Nowhere

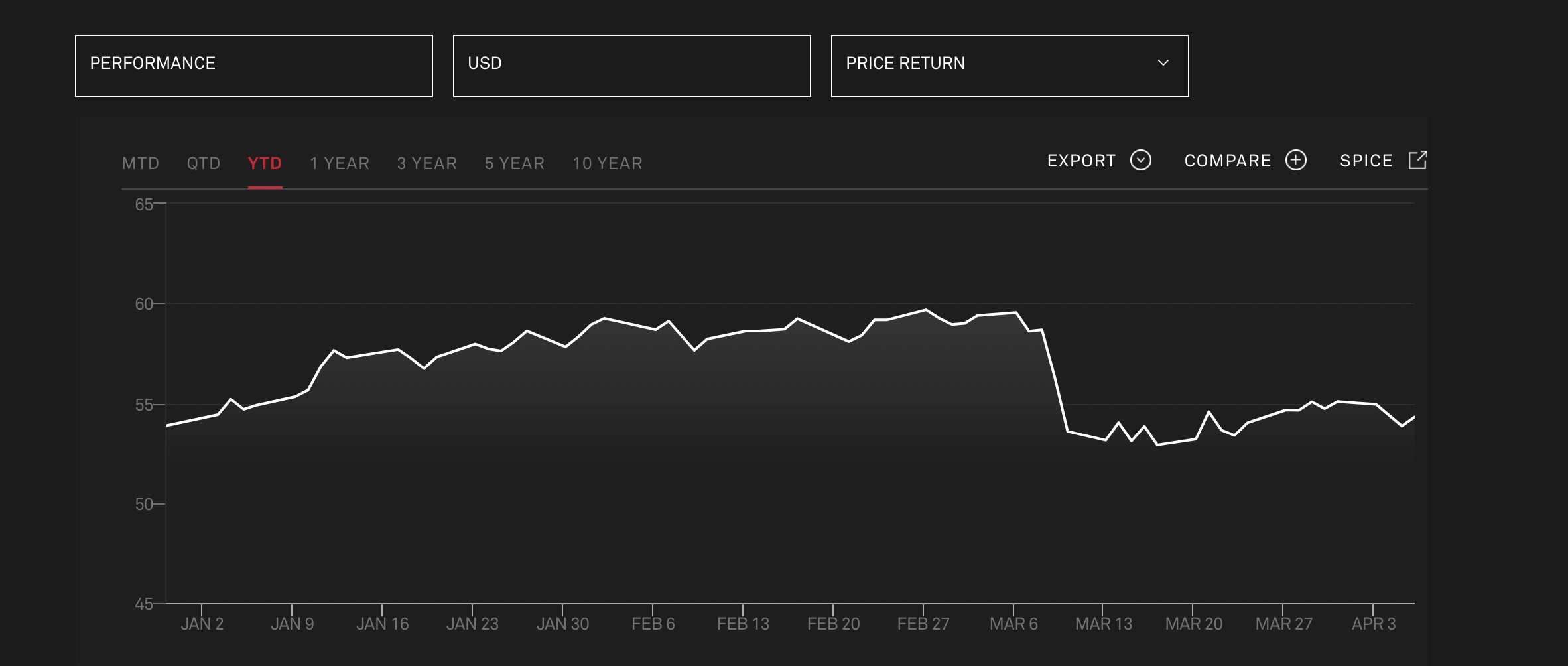

BDC prices have fallen and are not getting up much, following the catastrophe that was the failure of Silicon Valley Bank. The sector dropped by (11%); moved up modestly for the three weeks following and dropped again this last week through Thursday, April 6, 2023. Going by the BDC S&P Index, the sector is up just 2.7% on a price return basis from its lowest point during this saga, which was set on March 17, 2023. See below:

It's Good News

From a new BDC investor's perspective, this is welcome news. The prospective returns - if our dividend projections and terminal multiples prove to be even roughly correct - showing in the Expected Return Table are amongst the best ever. Ironically enough, even as BDC prices are languishing in the basement, the outlook for their long-term earnings and distributions are as rosy as they've ever been. Nothing much happened this week to make much of a difference in that regard as we are a month away from earnings season and there's little market-moving news. Even the titbits that we received from BDCs like Runway Growth (RWAY) - which detailed its IQ 2023 investment activity - did not have much impact.

Outlook

Doubts

Very high yields - including a 21.7% annual return at Trinity Capital (TRIN) after a punishing week for its stock price - are typically a useful sign that the current dividend is seen as unsustainable by the market in its collective wisdom. Including TRIN, 8 BDCs are offering yields of 15.0% or higher. Ironically, the very rich nature of the current yield must be keeping some investors away rather than drawing them to this potential honey pot. All we can say is that we project the numbers best as we know how and let the chips - and the valuations - fall where they may.

Case In Point

In the case of beaten-down TRIN, which fell (8.0%) this week, we're projecting a robust $2.50 per share total payout in 2023. In the IVQ 2022, the annualized running rate of Net Investment Income Per Share (NIIPS) was $2.48. On paper, with rates continuing to rise, TRIN's EPS should go higher, even if the analyst consensus is $2.26. Then there's a new joint venture coming into play this year, which should be accretive to earnings. Finally, let's not forget the $60mn of undistributed taxable income coming out of 2022, or $0.73 a share... Our $2.50 projection is only 7% higher than the $2.33 achieved in 2022 and not far off the $0.61 of total dividends paid in IVQ 2022, which annualizes at $2.44.

Being Careful

Nonetheless, we did double-check TRIN's credit performance when we saw the recent price slump - which actually began March 27 - in case we had missed something on that front. Yes, TRIN did get involved with crypto miners - a segment all of its venture debt peers managed to avoid. And yes, Core Scientific filed for Chapter 11 which resulted in a big write-down and suspension of investment income. However, there's now hope for a decent recovery at the bankrupt business and the other two firms are not causing any problems. One of them - Hut 8 - may actually get repaid at par shortly.

Pretty Good

The BDC's total underperforming assets - if you believe management's internal ratings - amount to just $50mn in a $1.0bn portfolio - one of the smaller percentages of troubled assets in both venture-debt lending and in the BDC sector generally. Try as we might when we looked through the 116 company portfolio we couldn't find any hint of the credit armageddon that might justify the BDC being valued at 4.7x our 2023 dividend projection and 5.2x the analyst EPS consensus. If we turn out to be wrong, it's going to be disappointing - but instructive. Anyway, we stand by our projections and valuation till we hear something to shift us.

By the way, we also ran a pro-forma case which mostly consisted of cutting TRIN's annual distribution between 2023-2027 back to the $2.33 achieved in 2022. The 5-year total return still remained outstanding at 218% - better than any other BDC. Clearly, the market here is positing a very sharp and dark change of fortune for TRIN and its shareholders. Or is it a standard case of a stock price overshooting to the downside? We've got 5 years to find out but we're likely to get a pretty good idea over the next 12 months whether TRIN's fundamental performance will become a disaster.

Not Much

There were no material modifications to the Expected Return Table this week. We still have a few Updates to write to ensure every BDC's projections and Total Return gets explained, but we were mostly busy looking at credit matters last week. An ever-greater database of underperforming companies in our BDC Credit Reporter database allows us to speak with more confidence about the outlook in BDC Best Ideas for earnings, dividends, and net book value in the short and long term.

Looking Forward

We're just terrible at guessing BDC price trends week-to-week. A week ago Friday we'd have bet that the sector's prices would have increased this week. That didn't happen, but we're doubling down and calling for the BDC S&P Index to move upward in the week ending April 14, 2023. Our logic? There are just too many BDCs offering very high, sustainable yields unless you're in Team Credit Disaster. Will the fear of "Something Bad Is Going To Happen" be enough to keep investors away even though BDC earnings and distributions are on the rise; inflation and risk-free rates are dropping and the Fed may be done raising its reference rate? We don't know, but if that fear continues, prospective BDC investors will have even more time to decide if those rosy returns we see coming are worth plumping for - or not.