BDC Common Stocks Market Recap: Week Ended September 27, 2024

Reprinted from the BDC Reporter

BDC COMMON STOCKS

Week 39

Zooming

We wonder if investors in the major markets – the S&P 500, the Dow Jones and the NASDAQ – realize how fortunate they’ve been of late.

This week, the Dow Jones “posted its 32nd record close for the year”, ending up 0.6%.

The S&P 500 also set new records, capping off a 34% increase in its price over the past 12 months, including 20.30% this year alone as we approach the three-quarter mark.

Over two years, using S&P’s own data, the index is up 60.0%.

No Way

If you’ll allow us a little foreboding commentary, these are unsustainable growth rates over the long term if historical data means anything at all.

The 100 year average increase in the S&P 500 is only just over 10% and ditto since the index actually increased to 500 securities back in the 1957.

From mid 1993 to mid 2023 – a 30 year period – the average total return was 9.90%.

We’re not going to be the one to predict when this boundless rally will end – and how – but nothing lasts forever.

Left In The Dust

Maybe we’re a little bitter because the BDC sector – despite paying record distributions of late thanks to the economic engineering of the Fed – has not kept up with the major indices, even when we factor in those dividends into the total return.

This week was positive enough, with the S&P BDC Index up 0.3% on a price return basis and 0.4% on a total return calculation.

26 BDCs were up in price – far more than the 16 that were in the red.

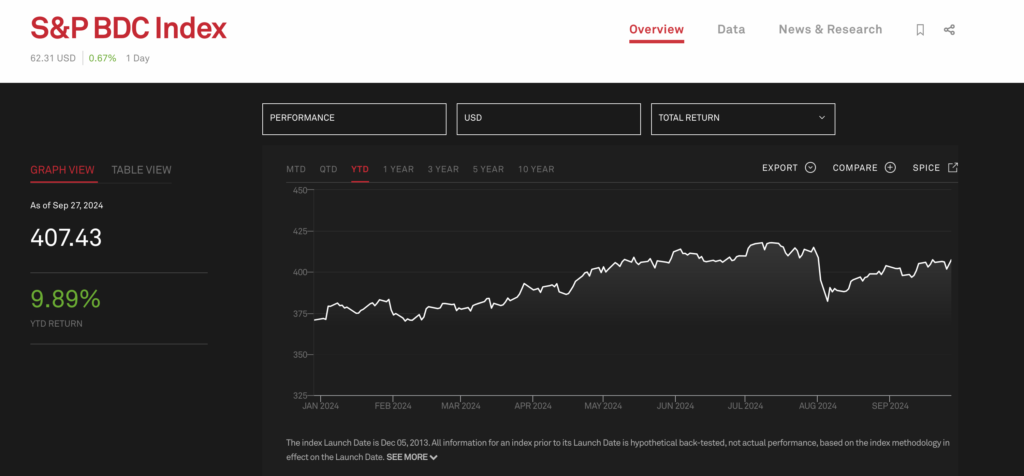

Year-to-date – and sticking with the S&P index of the BDC sector – we are up 1.81% on a price basis and 9.89% on a total return, as this chart shows:

Nonetheless, the BDC total return is only 46% of what the S&P 500 has achieved this year.

The Week That Was

Setting aside our green-colored glasses, let’s have a look at the rest of the week’s BDC stock performance data.

Two BDCs increased in price by more than 3.0% – the percentage increase that draws our attention.

These outsized winners were Gladstone Investment (GAIN) and Monroe Capital (MRCC). The former is still basking in the glow of selling an equity investment for a big gain, and immediately promising shareholders an unexpected “special” distribution.

Comeback Trail

As to MRCC, we’re surmising that investors believe the long-struggling BDC has “turned the corner” where credit losses are concerned.

The BDC’s Net Asset Value Per Share (NAVPS) – i.e. its equity – has dropped (27%) in the last 5 years, including (20%) since the end of 2021.

When most BDCs were raising their payouts during the “Golden Years” of private credit from 2022, MRCC was left desperately seeking to maintain its $0.25 a quarter dividend set in 2020, when first reduced from $0.35.

The stock price began to slump In November 2021 and a year ago was at a nadir of $6.85 a share, but has been recovering – in fits and starts – ever since.

This week, MRCC reached a new 52-week of $8.19, which represents a 20% increase from its lowest point but still well off the $11.67 price at which the BDC peaked in 2021.

The analysts are projecting MRCC will report NIIPS of $1.03 in 2025, down from $1.12 this year. At the closing price of $8.18 on Friday, MRCC’s PE on 2025 projected earnings is 7.3x.

The Other Side

2 BDCs fell more than (3%) in price this week: Logan Ridge Finance (LRFC) and Prospect Capital (PSEC).

The former was down (4.2%). We expect some investors were taking profits following the BDC’s run-up in price caused by its own sale of the same portfolio equity investment as GAIN.

At one point LRFC was up 16% in a matter of a few days on this news, but has now “given back” a quarter of what was gained.

PSEC is in a very different place where fundamentals are concerned but also saw its price bounce upward of late after reaching a 5 year low in August 2024.

That followed a negative article in Bloomberg with this sub-headline:

As Prospect Capital faces a surge in troubled borrowers paying interest with more debt, concerns over the fund’s finances are growing louder.Bloomberg – Private Credit Fund Burned by Risky Bets Is Bleeding Cash – John Sage and Ellen Schneider –

Again, we imagine some investors/traders took profits this week.

The controversial BDC dropped to $4.75 a share a few weeks ago, then rallied 17% till 2 weeks ago before dropping back again.

Snapshot

Given that’s we’re essentially at the end of the third quarter 2024 – and all the BDCs have now reported (see the News Feed for our comments on Investcorp Credit Management’s – ICMB – results for the quarter and year ended June 2024) let’s check some data.

BDCZ – the exchange traded note which we typically use as our number one price guide – is up 0.5% for the year. (The S&P BDC Index – as shown above – is up 1.81%, demonstrating that no one calculation exists).

BDCZ will have to increase 6.2% to match its 52 week, which is also its YTD high, set in June.

The S&P BDC Index – on a total return basis – is up 9.89%.

According to Seeking Alpha, 18 BDCs are in the black in 2024 and 24 are in the red.

Our own BDC NAV Change Table shows that only 13 BDCs saw their NAVPS increase this quarter versus 23 in the IQ 2024.

In 2024 YTD, 15 BDCs are up and 27 are down.

The culprit? Almost always realized and unrealized credit losses.

Moreover – and with a pinch more subjectivity – the BDC Reporter’s quarterly performance table counts 11 BDCs as underperforming in the IIQ 2024 versus 8 in the prior period .

Maybe tellingly, in the IQ 2024, we rated 10 BDCs as outperforming our expectations (4 or 5 on our 5 point scale) but only 1 attracted such a rating in the IIQ 2024.

10 BDCs are trading within 5% of their 52 week highs and 14 between 5% and 10%.

Conversely 6 BDCS are within 5% of their 52 week low and 10% between 5% and 10%.

8 BDCs have seen their stock price increase 10% or more – “doing well” – and 9 have seen a decline of (10%) or more – “doing poorly”.

That leaves 25 BDCs somewhere in the middle.

We calculate that roughly three-quarters of BDCs are in the black on a total return basis and one-quarter in the red through these 9 months minus one trading day.

We could go on but we won’t. We’ll just sum up the above like this:

The BDC sector is having an OK 2024 to date, albeit way below the major indices. There is a huge difference between the best and worst performers in terms of price, but also in NAVPS. About a fifth of BDCs are matching or beating the total return of the S&P 500. Another fifth are having an awful time.

Coming Up

We’re still weeks away from the next round of earnings season, with the exception of SAR, which closed its books at the end of August.

There’s always the possibility that a series of credit losses – realized and unrealized – will result in generally lower NAVPS and earnings in the quarter just ended.

However – relying on the data from our sister publication – the BDC Credit Reporter – we get the impression losses may be lighter in the IIIQ than in the IIQ.

Earnings will not be much impacted in the quarter ended September 2024 by the recent 50 basis point decrease in the Fed Funds rate.

What the Fed does or does not do,though, in the IVQ 2024 where rate cuts are concerned could materially impact the last 3 months of the year and set up for us up a different 2025 in a variety of ways.

In The News

Let’s just look at one: borrowing costs.

This week we saw CION Investment (CION) issue new Baby Bonds at 7.50% over 5 years.

Six months from now a BDC might be able to borrow significanyly cheaper for the medium term.

At the moment, in the BDC sector we still have an inverted yield curve where borrowing for 5 years unsecured is cheaper than borrowing secured for a short term.

That’s likely to change soon and alter every BDC’s economics and funding plans.

Just Round The Corner

As we’ve said before, the BDC sector – after a couple of Golden Years (or it three?) which we’ll be reminisce about for a long time – is on the cusp of a much more complex period in its history.

We have no doubt that – like Gloria Gaynor – we will survive, and even possibly thrive. However, for the first time in a long time, the BDC Reporter has some doubts and many quarters will need to pass before the situation becomes clear.