BDC Common Stocks Market Recap: Week Ended September 20, 2024

Reprinted from the BDC Reporter

BDC COMMON STOCKS

Week 38

The One With The Record Highs

This week – as almost everyone knows – both the Dow Jones and the S&P reached record highs on Thursday and all 3 major indices were up 1.5% on the week.

At this point, the S&P 500 is up 19.6% in price terms and 20.8% in 2024 when dividends are figured in.

Also common knowledge – and the spark for this latest stock price surge – is that the Federal Reserve chose to decrease interest rates by (0.50%) rather than (0.25%) as most were exopecting.

(We would have bet heavily – if we were a betting publication – on the (0.25%) cut, so color us surprised).

Neither This Nor That

Looking at the many metrics we cover every week, the BDC sector’s response to this week’s news was mixed – even a little confusing.

Let’s just start with the various ways we track overall sector price performance.

BDCZ – the exchange traded note which owns a weighted basket of BDC common stocks – moved up slightly to $18.98 from $18.96 the week before – a 0.1% increase.

BIZD – the only BDC sector ETF, but with a slightly different methodology, was unchanged on the week.

Finally, the S&P BDC Index on a price only basis – but also with its own proprietary brew of BDCs included – was down (0.3%).

Contradictory

If the BDC NAV Change Table is right – and we checked a couple of times – the number of BDCs trading at a premium to their net asset value per share (NAVPS) – increased from 14 to 16.

That contradicts the general movement in individual stock prices this week: 24 were down and 8 were up or flat.

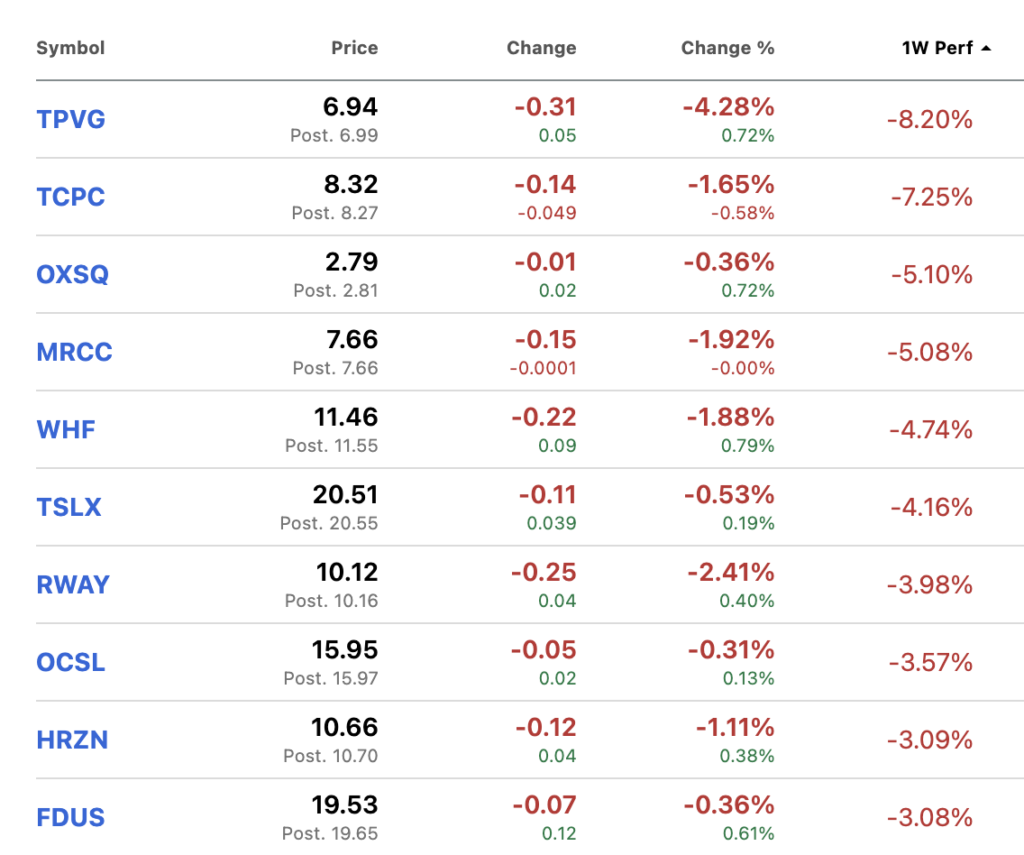

Moreover, the number of BDCs dropping by (3.0%) or more came to 10, versus only 2 up 3.0% plus.

Here are those price losers, as shown by Seeking Alpha:

Once Again

Leading the big pack – not surprisingly – are TriplePoint Venture Growth (TPVG) and BlackRock TCP Capital (TCPC), both of which posted new 52-week low prices this week – the only two in the BDC sector.

Over at the BDC Credit Reporter, we heard that one of TPVG’s portfolio companies – a German food delivery business – has just raised fresh capital and extended its “runway”, but that does not seem to have helped the stock price.

By the way, the Credit Reporter estimates further losses by TPVG could reduce its NAVPS by (10%). The stock, though, is trading at a (21%) discount.

As of Friday, on a recently reduced $1.20 per share annual dividend, TPVG is yielding 17.3%.

That’s the sort of yield that suggests either: i) the market expects more slashing of the dividend; ii) the stock is getting “over-sold” and may begin to attract would-be “bargain hunters”.

Re-Arranging The Deck Chairs

This week was notable for the managerial changes at BlackRock – both in the broader credit group and in the leadership of the BDC.

As covered by the BDC Reporter, the CEO/Chairman of TCPC is out, replaced by the BDC’s President Phil Tseng.

BlackRock is a very self confident asset manager – its credit results notwithstanding – and seems intent on improving its performance by making changes within its ranks.

Whether this will be enough to turn the corner for TCPC- which as this chart shows has seen its stock price drop by (44%) since June 2021 – remains to be seen.

Are We There Yet?

Chart watchers will have noticed the big price drop this week and the high volume of shares trading hands and some investors – like at TPVG – may be asking themselves if we’ve finally reached a bottom.

On the other hand, just looking at that chart, there have been 7 new lows made before this latest one…

TCPC is yielding 16.3% right now.

That suggests a cut in the distribution is coming but remember that the BDC has been paying a very modest percentage of its earnings out in the form of a regular $0.34 quarterly distribution.

The analysts are projecting TCPC’s Net Investment Income Per Share (NIIPS) will still be $0.39 in the IIIQ 2024 (versus $0.42 in the IIQ 2024), more than enough to maintain its distribution which has remained at this level for 4 quarters in a row.

By the way, the BDC Credit Reporter projects further losses from the level at mid-2024 will decrease TCPC’s NAVPS by (7%), but the stock trades at an (18%) discount.

Where We Are

As of Week 38, BDCZ is in the black for 2024 – just 0.1% ahead after 7 weeks in deficit.

On a price only basis, the sector is WAY behind the S&P 500 ‘s 19.6%.

However, on a total return basis – where BDCs to shine given its required high distribution rate – the gain is 9.5%, more than (50%) below its S&P 500 brethren.

20 BDCs are up in price this year and 22 are down.

At this stage, 7 BDCs are still trading within 5% of their 52-week highs and 16 are in the 5%-10% range.

That’s not as good as a few months ago when the BDC sector was running hot when the number of BDCs within 10% of their 52 week peak amounted to 30-31, but not terrible.

A little more disturbing for BDC bulls is that 7 BDCs are trading within (5%) of their 52 week lows and 11 (5%)-(10%) down.

Back in June there were no BDCs scraping the bottom and the total number of underperformers was only half the current level.

Maybe we’re generalizing too much from the TPVG and TCPC examples, but we get the impression that investors are taking a more cautious view on the weaker BDCs given the low level concerns about the economy and the inevitable impact of lower interest rates on BDC profitability.

Downshift

After all, thanks to the Fed’s rate decrease, this quarter will be the first in a very long time to see SOFR dip from its 5.3% level where it’s hovered.

SOFR was already headed downward before the Fed’s and is now at 4.82%.

If we do get another (50 bps) cut in the IVQ 2024 – as most are predicting – SOFR will end up (20%) below its level at the end of August.

BDCs with portfolio loan yields of 10%-11% in the IIQ 2024 will have to contend with annualized investment income levels about a tenth lower and – presumably – with more to come.

Time For A Change

We imagine BDC managers – as well as BDC analysts and investors – will be constantly resetting their financial models because – after a year of rate stability – everything has changed.

Not only will the economics of BDC lending and borrowing constantly change as the Fed does this or that for the next several years but so will the economics of the thousands of borrowers.

We may see less troubled borrowers once interest rates really get going and there may be an improvement in EBITDA to debt service ratios.

However, the next few years may also see a revival in LBO activity and lenders – loaded up with capital – may be willing to do deals on much friendlier terms than in the recent past, attracting a slew of weaker borrowers with dire consequences down the line.

We don’t pretend to know for certain but – as we’ve said – this much anticipated turning point where rates begin to fall has been reached and introduced a new point of uncertainty to go with all the others BDCs and their investors have to contend with.