BDC Common Stocks Market Recap: Week Ended March 21, 2025 - ANNOTATED

March 23, 2025

Re-Printed From the BDC Reporter

BDC COMMON STOCKS

Week 12

For the week, the S&P (SP500) advanced +0.5%, while the tech-heavy Nasdaq Composite (COMP:IND) added +0.2%. The blue-chip Dow (DJI) climbed +1.2%.

Seeking alpha – wall street breakfast – march 22, 2025

Dead Cat Bounce?

The S&P 500 managed to avoid a streak of 5 losing weeks in a row, with its modest advance, and the other major indices were in the black as well.

Arguably, this may be the calm before the storm, with the Trump Administration’s “Liberation Day” of April 2, 2025 just round the corner.

Given that we don’t know much about which reciprocal tariffs may be imposed – and which not – and how the rest of the world will react, etc there could be further market turmoil ahead.

We’re Back. Sort Of.

For this week at least, though, investors were tentatively returning.

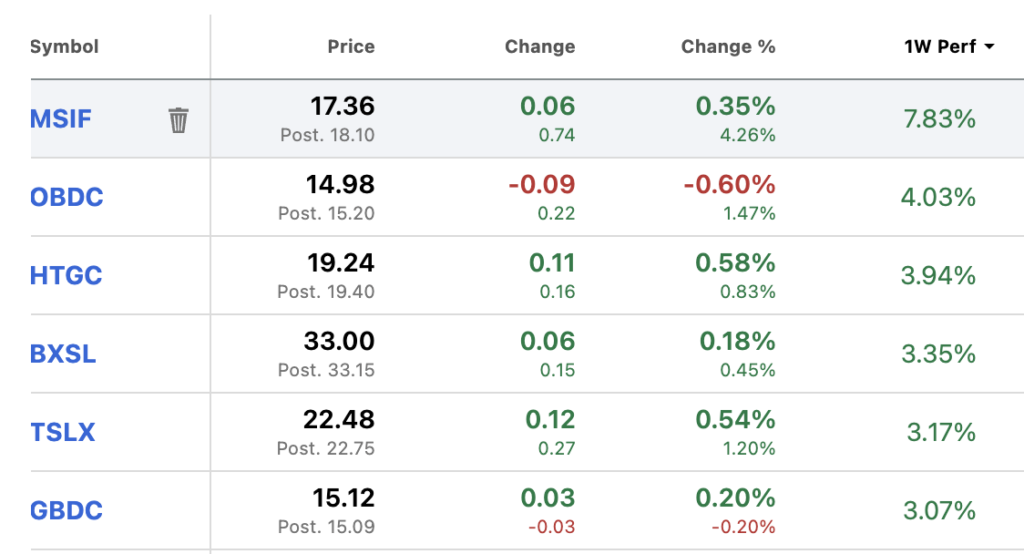

The BDC sector – as reflected in the price of the exchange-traded fund with the ticker BIZD – moved up 1.3% , to $16.71.

The S&P BDC Index – on a price basis – was up 1.5%.

Of the 46 public BDCs we track, 27 were up and 19 were down.

You can see in the metrics, though, that this was a tentative uptick.

6 BDCs in the black increased in price by more than 3.0%.

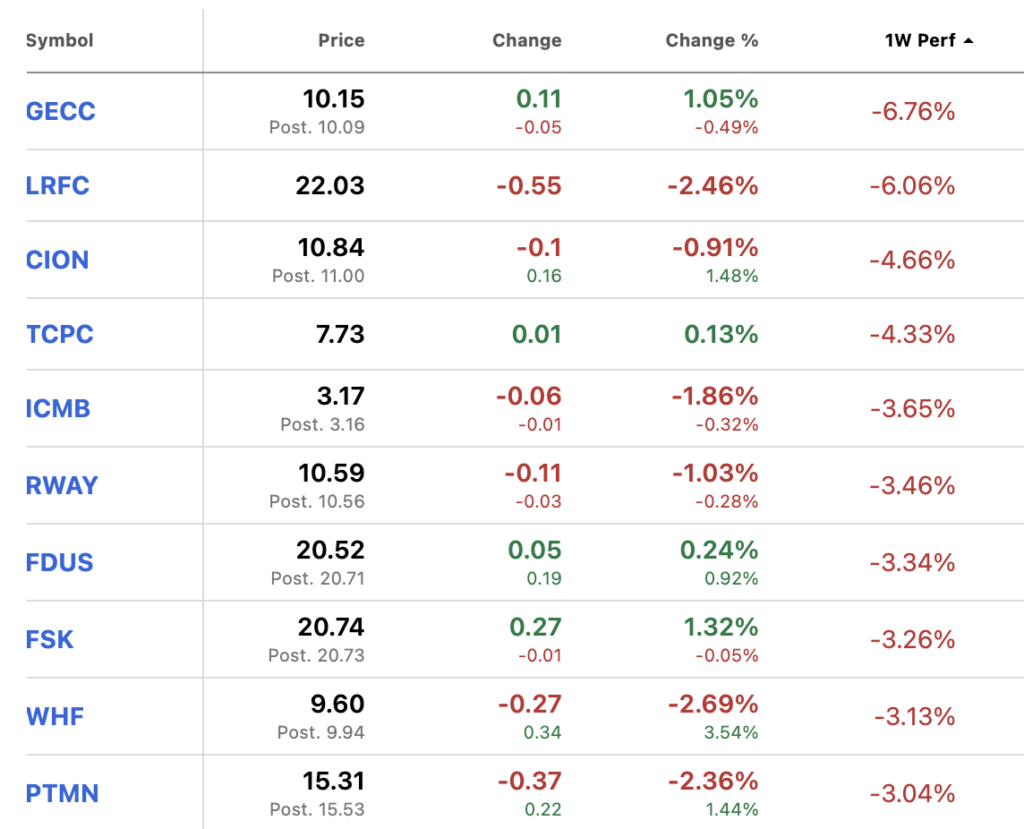

However, 10 of the BDCs in the red fell by more than (3.0%).

Alone

For all the material price swings up and down no BDC reached a new 52 week high and only 1 reached a new 52 week low.

That was BlackRock TCP Capital (TCPC) – which happens to be under our scrutiny at the BDC Credit Reporter right now as we attempt to determine if there’s any prospect of a turnaround at the beleaguered BDC.

Based on our research so far – and everything that has come before – we’re not surprised that investors continue to throw in the towel where TCPC is concerned.

Rough

Net Asset Value Per Share (NAVPS) has dropped (22%) in the last 12 months and (36%) since the end of 2021.

That’s a huge percentage especially for a BDC that was well regarded for many years both before and after being acquired by BlackRock.

Here is a stock price chart dating back to April 30, 2021 and reaching to last Friday which shows the inexorable descent of TCPC, albeit peppered with mini price recoveries along the way that never last for long.

TCPC has lost half its value in these (nearly) 4 years.

Worse

The most telling statistic about TCPC, amidst a myriad amount of them, is this one, drawn from the latest earnings press release:

“As of December 31, 2024, debt investments on non-accrual status represented 5.6% of the portfolio at fair value and 14.4% at cost, compared to 3.8% of the portfolio at fair value and 9.3% at cost as of September 30, 2024”.Source: BlackRoCK TCP Capital 2/27/2025

Not only is the level of non-accrual assets very high by BDC standards – valued at cost – but has increased substantially in the most recent quarter.

Most of the time, a BDC will recognize a spike in non-performing assets and subsequently chisel away at the number through restructurings; sales and write-offs.

TCPC has been on a downward slide for years and its velocity – going by the above – is only accelerating of late.

Valuation

TCPC closed at $7.73 on Friday, trading at a (16%) discount to book and a multiple of 5.8x its analyst projected 2025 recurring earnings.

Going by the latest quarterly payout ($0.25 regular and a $0.04 special), the current yield is a whopping 15.0%.

We expect bargain hunters will shortly begin to circle TCPC as they’ve done so many times before.

While We’re On The Subject

With only one BDC left to report, the BDC NAV Change Table clearly shows there are 10 BDCs that have performed poorly in 2024 where NAVPS is concerned, with declines of (6.0%) or more.

That’s a relatively high proportion of the public BDC universe and a little disconcerting given the relatively good economic conditions we’ve been in.

Nor is the picture any better if we look back 3 years. The Table shows 14 BDCs whose NAVPS has dropped by (16%) or more.

What the data seems to show above all else is that when a BDC becomes credit troubled – and its NAVPS drops sharply – it is very unlikely that a few years later the situation will be much improved – and could be seriously worse.

We’ll avoid the super-tanker analogy, but you get the idea.

Where We Are

BIZD is now (6.4%) beneath its 52 week and 2025 YTD high, but also 3.5% above the lowest level this year, reached on March 13, 2025.

At this point, 16 BDCs are trading at or above book value and – a little shockingly given the market turmoil – 22 individual BDCs are in the black this year.

Only 5 BDCs are trading within 5% of their 52 week peak prices and 9 are within (5%) of their lowest price.

The S&P BDC Index – on a total return basis – is up 1.0% after 12 weeks, much better than the S&P 500’s (3.3%) own “total return”.

Nonetheless, this is sub-par performance.

Where We’re Going

Looking at the macro picture – and leaving aside whether we will or won’t have a recession – BDCs should benefit from the slowing pace of Fed rate cuts.

Not so long ago there was talk of 4 cuts in 2025. Now, the consensus number is 2.

We could foresee a situation where the actual number is zero.

That – everything else being equal – would keep BDC earnings higher than previously anticipated.

Long Shot

There is a possibility – if the Fed does not cut rates this year or only in the final quarter – that BDC earnings might flatten out in the second quarter of 2025.

Previously, the assumption was that earnings would step down all the way into 2026 without interruption.

Harder to fathom is whether BDC portfolio companies will be much affected by higher inflation – also the consensus view.

To date, BDC financed companies have shamelessly been able to pass along those higher costs to their customers.

This time, tariffs could make this passing of the buck more problematic, but we’re not presuming to know.

It’s Quiet Out There

We’ve heard from multiple BDCs – and from other sources – that loan activity has screeched to a halt in recent weeks given the uncertainty surrounding…everything.

That’s not good news for BDCs in some ways and good in others.

This might mean less in the way of fees and acceleration of OID but also less refinancing pressure at very low yields.

Finally..

As we warned at the beginning of the year, price volatility – to state the obvious – is very high and should remain so.

The future is always uncertain but there are times when one feels almost anything could happen.

This is one of those times.